Are Casino Winnings Taxed In Canada

- Are Casino Winnings Taxed In Canada 2019

- Are Casino Winnings Taxed In Canada Now

- Are Online Gambling Winnings Taxable In Canada

- Are Poker Winnings Taxable In Canada

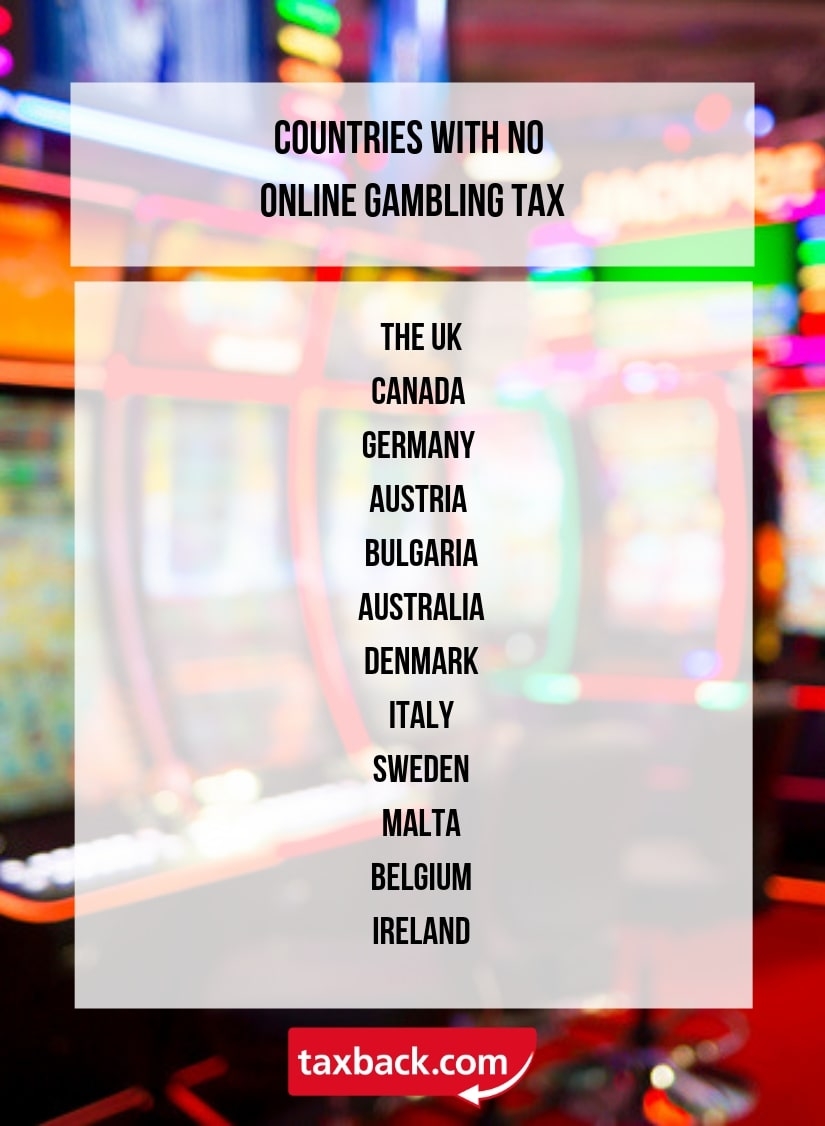

The short answer is no. Your online winnings are not taxable in Canada, unless you are a professional gambler living from your earnings. Even that is a roller-coaster ride when you consider big wins as profits and large losses as expenses to offset those profits.

If you’re a resident of Canada, you don’t have to report any of those gambling winnings in Canada. You are also not eligible to claim a foreign tax credit on your tax return in Canada because you did not report any income outside the country. The only time you need to report income earned from gambling is if you’re running a gambling. Gambling in Canada Whether one is betting on sports events, casino games or other forms of gambling, winnings are not taxed by the Canadian law. Winnings that are obtained from online gambling sites in Canada are never taxed. However, when it comes to poker, there is an exception.

Under the Canadian Income Tax Act, all winnings from playing casino games are taxable. At first, this may sound unfair and unreasonable, but the CRA treats casino winnings as “business income” due to the professional gamblers, who earn their money by placing bets in the casino. Largely Canadians, these winners have never experienced such a situation from casinos in any province of Canada. The reason is very simple. Gambling winnings are not taxable in Canada. Whether it’s a casino or a lottery win, the law is very clear. These amounts are not considered taxable income.

Why Don’t Online Casino Players Pay Taxes On Their Winnings?

When you win playing online casino games, Canadian laws do not see these winnings as income to be taxed. This is because, in the eyes of the law, a player’s winning amount is due to luck, not an expectation. The origin of the tax law is a long-standing principle from British Common Law, codified in Canada under paragraph 40(2) (f) of the Income Tax Act. This has been upheld by the Canadian Courts, as long as the profits are not business-related. Three categories deal with taxation on gambling winnings:

- If a player makes enough to maintain his standard of living, it does not in itself make the amount taxable.

- No matter how much you enjoy online gambling, and how much attention you give it, it does not make it taxable.

- A system for minimization of risk can distinguish between a professional and an intemperate gambler. Once again, an intemperate gambler’s winnings are not taxable.

Canada does not licence online casinos, other than those issued licenses from the Kahnawake Gaming Commission (KGC). Playing and winning at a KGC online casino, or any other licenced online casino, means your winnings are your own.

There are many legit online casinos where you can play tax-free. For example, Quatro Casino is licensed under KGC and allows you to legally collect your winnings tax-free. However, this exemption does not apply if you are considered a professional players.

Big And Small Lottery Wins Exempt From Tax!

Yes, you have read that correctly; even a life-changing lottery win will not be taxed. So, you can play on any Canadian lottery like Lotto Max and enjoy the results of your wins. The reason behind this is that Canadian Law perceives a lottery win as a ‘windfall’ and exempt from taxation.

Be careful though, as some countries do impose a tax on lottery winnings, for example, the USA. If you choose to play on an American lottery via an online site, you could still be taxed 30% of your winnings by them!

What is taxable in Canada is interest from any winnings. Interest from any banked or saved winnings must be declared on a T5 form, and you could be fined for not doing so.

Can You Keep All Your Winnings When Playing In A Land-Based Casino?

Gambling became legal in 1972 and opened the door to land-based casinos in Canada. Seven out of the ten provinces allow gambling. Here, yet again, wins are not taxable. As long as you are not a professional Poker or Blackjack player and playing is not your main source of income, you get to keep it all.

Land-based casinos are licensed by the province in which they are situated. One such province is the Kahnawake National Reserve which is a Mohawk territory located within Quebec. The area operates land-based casinos and can regulate online casinos, Poker rooms and Sportsbooks.

A final word on gambling taxation is that if you receive a gift from a gambling win, this has to be declared, or you could face legal action. But, all your own winnings if not gained professionally or as your only source of income can be initially collected tax-free. Just remember interest on any such wins needs to be declared.

In Canada, the laws pertaining to the ownership of online casinos are quite strict. Namely, only the government is allowed to own an online casino that has its headquarters within Canadian borders. For others, though, it is illegal. Nevertheless, a way to bypass these laws has been found. Many online casino owners from this country decided to operate from other jurisdictions where online gambling is legal. From there, they offer their services to Canadian players.

The laws pertaining to the players themselves, on the other hand, are rather relaxed. In fact, gamblers from Canada are allowed to play in any online casino they like, regardless of its location. Also, you will not be required to pay any taxes for your winnings most of the time, unlike in the US, where all winnings of $1200 or more are subject to a 30% tax.

There are some situations in which winnings have to be taxed, though, and they will be discussed in this article.

Do I Need to Pay Taxes on My Winnings?

Most Canadian gamblers are not expected to pay any income tax on their winnings, since these prizes are not really considered to be a viable source of income. The government simply does not see this kind of taxing as just or fair, as the majority of Canadian players do not make a living this way and gambling is not their career.

Nevertheless, there are gambling professionals who earn most of their money from games of chance, which is why they are expected to pay taxes on their prizes. For example, everyone who runs a gambling business needs to declare their profit from it on a tax form. Moreover, according to the Canadian Income Tax Act, a person is seen as a professional gambler if gambling is their exclusive source of income, or if he/she uses a specific set of skills to make a long-term profit. This is why poker players are more likely to be seen as professionals than others, as poker relies on skills just as much as it relies on luck, if not more.

As a result, those players who do not fit any of these criteria are seen as non-professionals, regardless of how much time they spend playing or how much money they make while gambling. Even if someone is an avid gambler, they will not be seen as a pro, unless they make their living doing this exclusively.

This law pertains to all the popular casino games, such as slots, blackjack, poker, and roulette, among others, and it is used to govern both online and offline forms of gambling.

How Should Professionals Calculate Their Taxes?

Professional gamblers are considered to be running their own freelance business, which is why they need to file taxes on their prize money. The winnings are taxed just like any other kind of income, while all the losses are seen as expenses and are, thus, deductible.

However, bear in mind that in each of the ten provinces and three territories, there are different income tax rates, which is why you have to be careful when filing your taxes.

For example, in Quebec, tax rates are higher than anywhere else in Canada, which is why the first C$43,790 of taxable income is subject to a 15% tax in this province. For the next C$43,785, an additional 20% tax is applied. The tax rate for the next C$18,980 is 24%, and for any taxable income of C$106,555 or more, a 25.75% tax will have to be paid.

On the other hand, you will find the lowest income tax in Nunavut, where 4% is paid on the first C$45,414, 7% on the next C$45,415, and 9% on the following C$56,838. Every amount of C$147,667 will be subject to 11.5% tax.

Are Casino Winnings Taxed In Canada 2019

Remember, these rules only apply to professional gamblers, as defined in the previous paragraph. Non-professional players are exempt from paying taxes for their prizes and winnings.

Are the Laws the Same in Every Part of Canada?

Canadian provinces and territories are considered to be self-governing entities. That is why each of them has been allowed to pass its own acts regarding gambling. Basically, your location in Canada determines what kind of gambling you will be allowed to participate in legally and how old you have to be in order to take part in these activities.

However, in each of the provinces, you will be seen as a professional if you fulfill the criteria mentioned above. Also, even though tax rates differ from province to province, the fact that you have to pay taxes if you are a professional player remains.

Are Casino Winnings Taxed In Canada Now

Final Thoughts

Are Online Gambling Winnings Taxable In Canada

In Canada, online gamblers who make a living playing games of chance are perceived as professionals, which is why their winnings are seen as income and are, therefore, taxable. The tax rates will depend on the players’ location, as they differ in each of the provinces and territories. However, those who have another job or career will not be considered professionals and will not be expected to pay anything.

Are Poker Winnings Taxable In Canada

Still, this information is subject to change. If there are any doubts, make sure to contact an accountant or a tax lawyer, as they could provide more details regarding taxes and online casino winnings for each of the provinces and territories in Canada.